2025 Canada Federal Budget - Deep Dive Summary: Housing, Real Estate & Mortgage Impacts

2025-11-06 | 09:33:02

2025 Canada Federal Budget November 4, 2025 | Posted by: Sean Malachi

Deep Dive Summary: Housing, Real Estate & Mortgage Impacts

Major Housing & Mortgage Measures

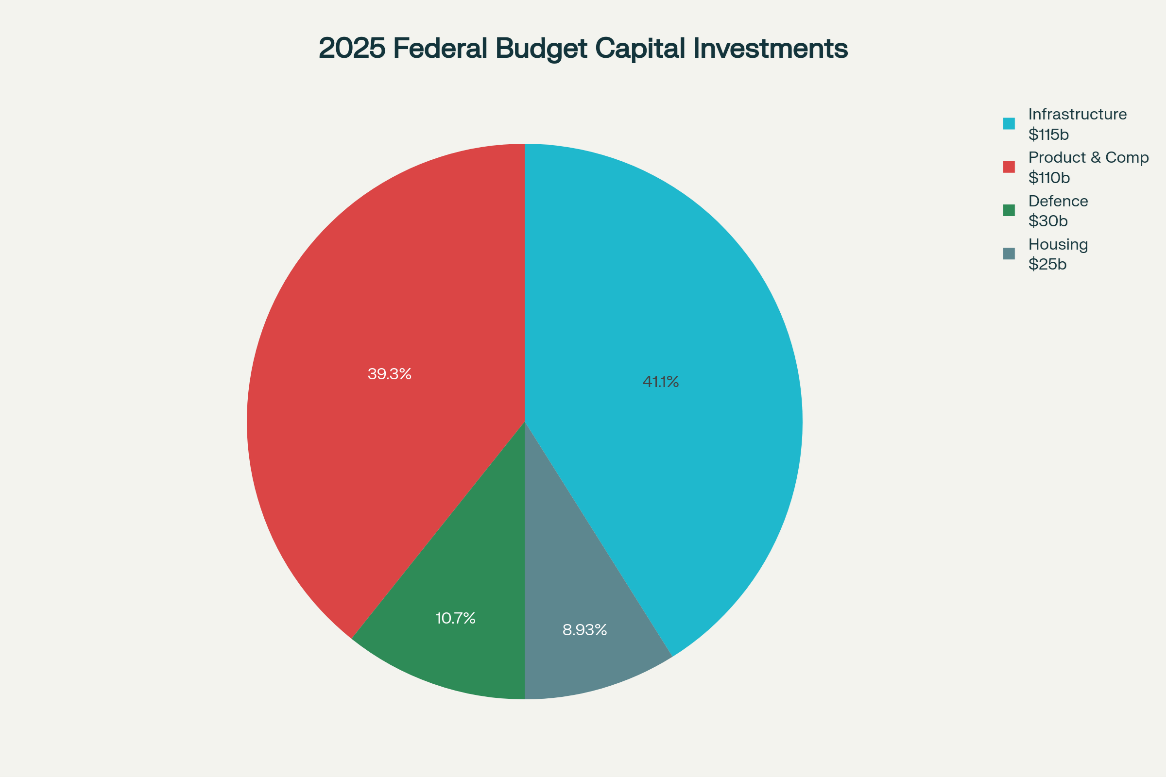

- $13B Build Canada Homes Agency: Accelerates affordable and non-market home construction. Goal: 430,000–480,000 homes/year using modular and advanced construction to reduce costs and emissions.

- GST Elimination for First-Time Buyers: New homes up to $1M see a 5% GST rebate. Makes homeownership more accessible by lowering entry prices.

- Canada Mortgage Bonds (CMB) Expanded: Limit raised to $80B a year, unlocking financing for multi-unit/rental housing and boosting housing supply.

- Rental Housing Push: Record levels of completions. Declining rents (-3.2% YoY) signal improved conditions for renters.

- Infrastructure Support: $51B for development-enabling infrastructure to keep prices lower.

- Indigenous & Rural Funding: $2.8B for Indigenous housing; ongoing rural and northern initiatives.

- Tax/Program Rollbacks: No Secondary Suite Loan Program, underused housing tax not proceeding, eases compliance for owners/investors.

National & Regional Market Dynamics

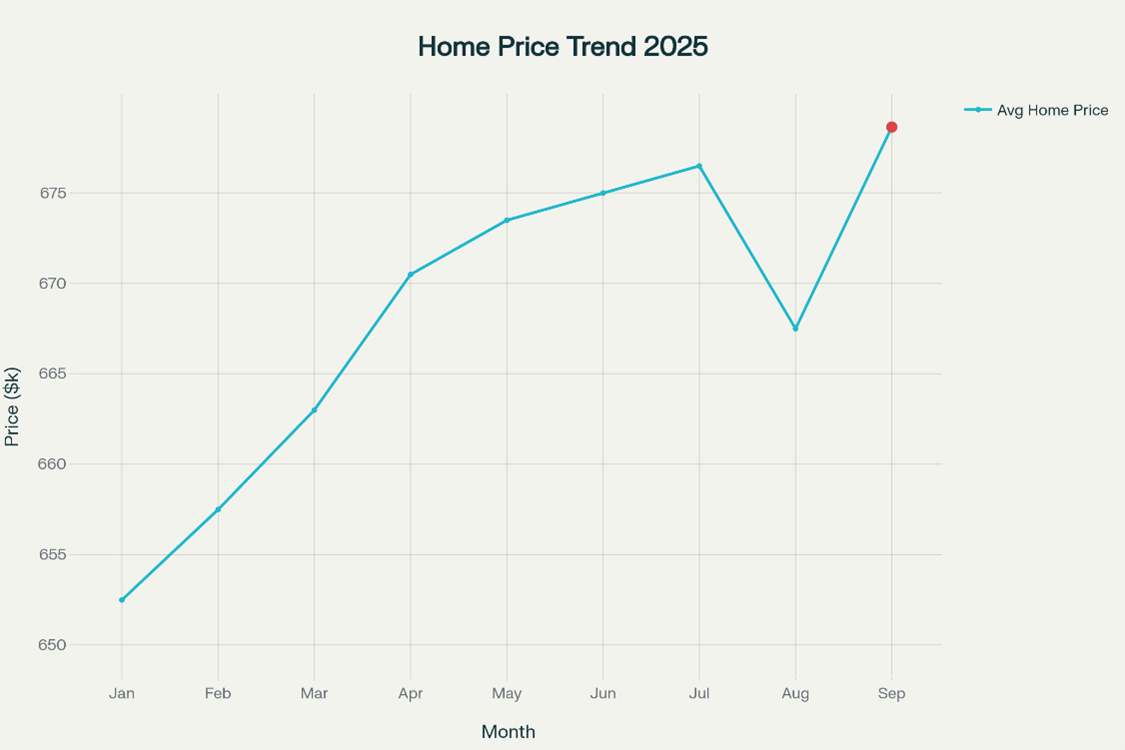

- National Average Home Price: $676,154 in September 2025 (+1.8% MoM, +1.0% YoY).

- Interest Rate Environment: Bank of Canada at 2.25% (down 2.75 points since mid-2024), which improves affordability.

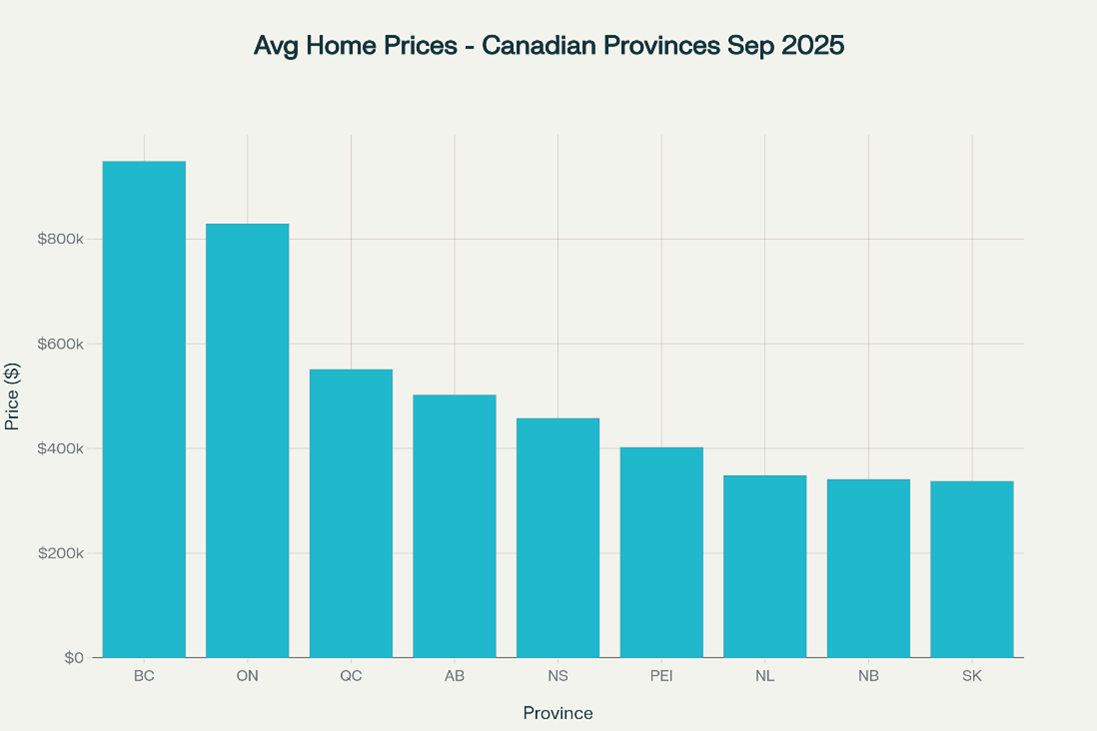

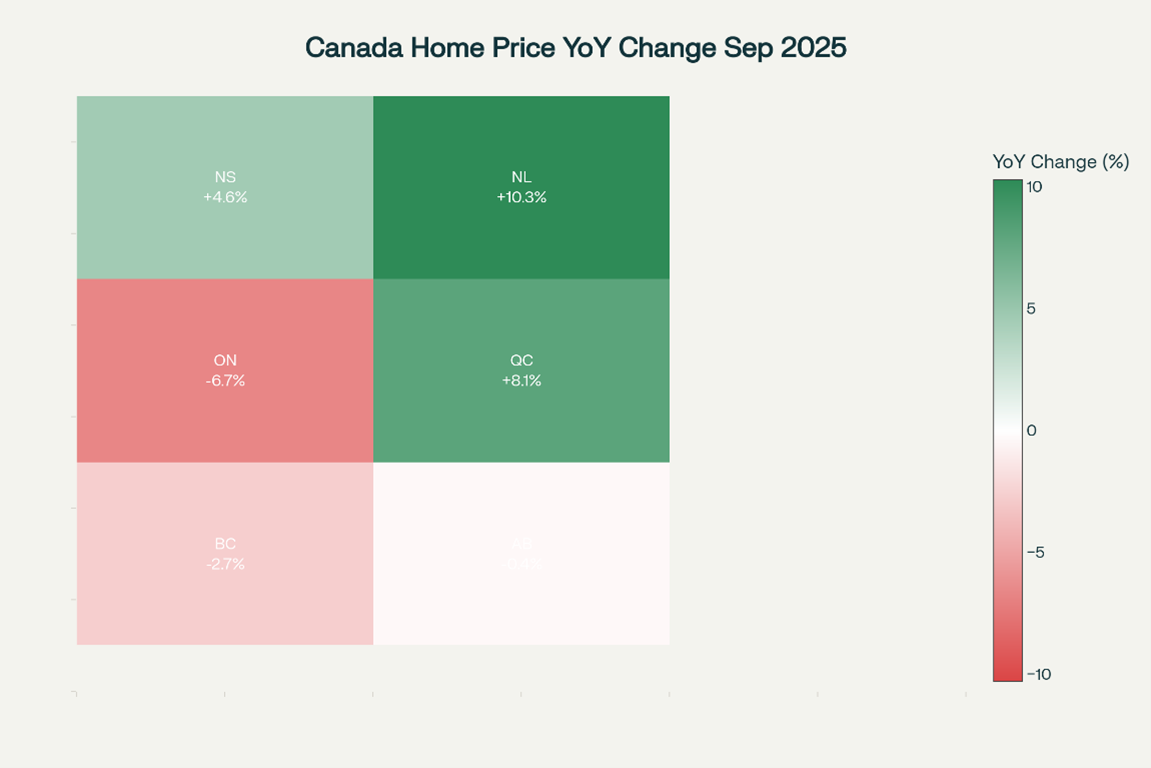

- Regional Home Price Changes (YoY, Sept 2025):

- Ontario: -6.7%

- British Columbia: -2.7%

- Quebec: +8.1%

- Nova Scotia: +4.6%

- Alberta: -0.4%

- Newfoundland: +10.3%

Average Home Prices by Province (Sept 2025)

Average Home Prices by Province - September 2025

National Average Home Price Trend (Jan–Sept 2025)

Canada National Average Home Price Trend (Jan-Sep 2025)

2025 Federal Budget: 5-Year Investment Breakdown

Canada 2025 Federal Budget: Planned Capital Investments by Area (5-Year Horizon)

Regional Annual Home Price Change Heatmap (Sept 2025)

Regional Annual Home Price Change (%) by Province (Sept 2025)

Infographic: Key 2025 Canadian Mortgage Impacts

- Top four points:

- CMB limit raised to $80B/year for rental liquidity.

- GST removed for first-time buyers (new homes up to $1M).

- National average home price: $676,154.

- Bank of Canada rate: 2.25%.

Infographic: Key 2025 Canadian Mortgage Impacts

Advice for Real Estate Investors

- Target multi-unit/rental investments: Federal programs and increased CMB funding make these attractive.

- Watch regional shifts: Consider Atlantic Canada and Quebec for price growth; monitor softening in Ontario and BC for value buys.

- Act on incentives: Use GST relief for new builds, and watch for infrastructure-driven value spikes.

- Prepare for renewals: Budget for rising rates after 2025 and review terms for flexibility.

- Leverage rental market strength: Consider long-term strategies as completions are high and vacancy levels are moderate.